Bollinger shelves consumer EVs to focus on commercial trucks

Henry Payne

Henry PayneThe imposing, battery-powered Bollinger B2 pickup truck won’t be seen on the road anytime soon.

The Oak Park-based startup announced Friday that it is canceling consumer orders for its innovative, off-road-capable B2 pickup and B1 SUV in order to focus on its burgeoning commercial truck business.

The $125,000 B1 and B2 were part of a squadron of epic super-trucks — including offerings from Rivian, GMC, Chevy, Ford, Tesla and Lordstown Motors — coming to market in the wake of Tesla’s success as a luxury electric vehicle maker. The $74,000 Rivian R1T pickup Launch Edition began customer deliveries at the end of 2021, as did the $113,000 Hummer EV Edition 1, but Bollinger’s announcement is an indication that the volume demand for EV trucks is in the commercial, not retail, sector where the lofty prices are only attainable by a few.

“We’ve been in development on the commercial front for quite some time. This has been growing and growing,” CEO Robert Bollinger said in an interview. “We've had large fleets looking at (our battery-powered platform). We just read the writing on the wall. Most of our employees are on the commercial side, and so I made a decision to defund the B1 and B2.”

The decision wasn’t easy for the entrepreneur, who began Bollinger Motors on his New York farm in 2015 with a passion for building an eco-friendly EV pickup with unique performance attributes. The boxy B2 was born.

Unveiled at a glitzy Times Square event in 2017, it featured gob-smacking numbers like 614 horsepower and 668 pound-feet of torque, zero-60 mph acceleration in 4.5 seconds, 5,000-pound payload capacity, and a suspension that offered variable ground clearance of 10 to 20 inches. The truck’s signature attributes were Jeep Wrangler-like removable body panels, and a unique, hollowed-out interior that could swallow objects up to 16 feet long by dropping the vehicle's tailgate, midgate and front gate.

"It was time we did something new," Bollinger said at the time. "I just wanted to build the best truck without compromise."

Bollinger moved the company to Metro Detroit to take advantage of the region's deep engineering and manufacturing talent. The company showed pre-production prototypes in late 2019 of a B1 SUV model to be hand-built alongside the B2 truck. Initial production for the $125,000 vehicles was sold out with a reservation list of 30,000.

The B2 turned heads at last fall’s Motor Bella show in Pontiac. Bollinger Motors will refund deposits for those who had reserved B1 and B2 models.

A passionate environmentalist who has self-funded Bollinger Motors with a personal fortune gained from selling his New York cosmetics marketing company, Bollinger sees the commercial truck direction as the best way to pursue his green goals.

“It’s clearly the correct decision even if it's hard for me to set aside my love” for pickups, he said. “I replaced that for the moment with the incredible amount of impact you can have with commercial fleets. The amount of CO2 we can take out of the air and the particulates is incredible.”

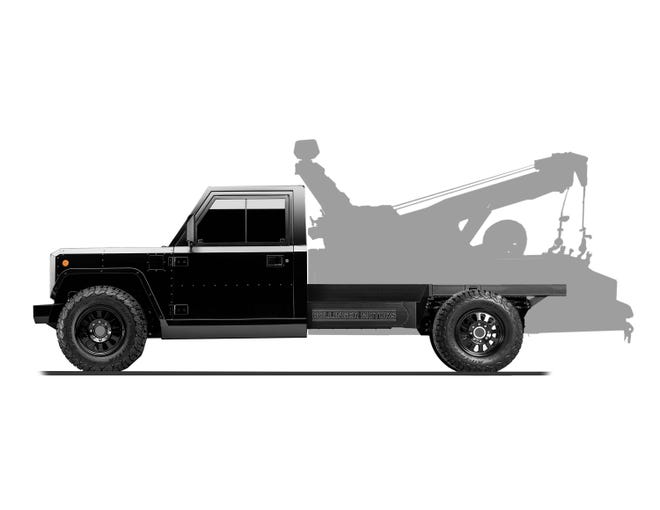

Bollinger says that “upfitters” (companies that equip vehicle platforms for commercial applications) and fleet buyers will use his raw, skateboard battery platform for a variety of uses quite different from its original, dirt-kicking aspirations. The rear-drive platform can be scaled to different wheelbases and battery sizes for use with heavy-duty utility vehicles, tow trucks, small garbage trucks, and municipal buses.

He sees Bollinger’s opportunity in medium-duty Class 3-6 trucks — capable of gross vehicle weight ratings (GVWR) from 10,000-26,000 pounds. That’s different from competitor platforms like the Rivian, Ford F-150 Lightning, Chevy Silverado and Lordstown Endurance EV platforms that are targeted at Class 2 GVWR pickup applications (6,000-10,000 pounds) like Amazon delivery trucks — or Class 1 vehicles (0-6,000 pounds GVWR) like the electric Ford E-Transit and GM BrightDrop vans.

Government and corporate ESG (Environmental, Social Governance) policies are driving fleet purchases as well as the promise of government subsidies for charging infrastructure. EV trucks lag gas-powered trucks in towing range, but Bollinger sees most fleet applications as limited, low-mileage routes. Bollinger manufactures its own battery packs and will supply platforms with 70-kWh, 140-kWh and 220-kWh capability. By comparison, the Tesla Model 3, the most popular EV in the U.S. market with 320 miles of range, sports a 82-kWh battery.

“(Commercial EV fleets) are where everything is going as far as regulations from states,” said Bollinger. “Maybe the federal government too. All the expectation on the commercial side is really going to be the driver for the volume of vehicles turning electric.”

While sexy sedans like Teslas, Mercedes EQS and Lucid Air turn heads, auto startup and legacy automakers alike see gold in commercial trucks.

GM, too, has wowed with $100,000-plus retail super-trucks, but it’s the fleet-focused Silverado EV Work Truck that will first come to market in early 2023. Ford’s F-150 Lightning EV is also teasing wealthy first adopters with $90,000 Lightning Platinum models, but its base $40k Pro trim is targeted at commercial fleets.

Startup Lordstown Motors had ambitious plans to produce thousands of commercial trucks based on its Endurance pickup platform. Delayed by financial issues, the Endurance is expected to come out this spring under a production contract with Foxconn.

Bollinger, too, will soon announce a production partner for its Class 3-6 platform. It will not provide charging infrastructure — a big challenge that commercial customers are just getting their arms around.

“There's a lot of capital companies that offer the capital for these companies to switch over” to electric fleets, said CEO Bollinger. “You have to change a depot that, for example, has 100 trucks and you need 100 chargers. And they all have to be fast chargers and your whole building needs a new amount of power coming in from utilities. It's a big package.”

Bollinger regretted having to cancel orders on his beloved B1 and B2 off-road beasts, but hopes to return to them someday.

“We wouldn't be here without our deposit-holders,” he said. “We can’t thank them enough and and hopefully they'll continue to follow our progression, even if it's not something that they can buy for themselves right now.”

Henry Payne is auto critic for The Detroit News. Find him at hpayne@detroitnews.com or Twitter @HenryEPayne.